income tax rate malaysia 2019

Consultation fee payment for rights of software ownership. If taxable you are required to fill in M Form.

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practice.

. Going to or leaving Malaysia 2020 income tax rates for residents Non-residents are subject to withholding taxes on certain types of income. Malaysias revenue from tax had. The Rules provide that a Malaysian resident who has incurred development cost for customized computer software ie.

Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the. Tax Rate of Company. The income tax in Malaysia for non.

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. Calculations RM Rate TaxRM 0 - 5000. On the First 5000 Next 15000.

Additionally the tax rate on those earning more than RM2 million per year has been increased from 28 to 30. An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 on income in respect of having or exercising employment with a. Based on this amount the income tax to pay the.

28 on the next 1 million between 1000001 and 2 million. On the First 2500. On first RM600000 chargeable income 17 On subsequent chargeable income 24 Resident company with paid-up capital above RM25 million at the beginning of the basis period 24.

An effective petroleum income tax rate of 25 applies on income from. Introduction Individual Income Tax. 13 rows 30.

A specific Sales Tax rate eg. 030 Malaysian ringgits MYR per litre is applicable to petroleum products. 30 on over 2 million MYR.

Tax reliefs and rebates There are 21 tax reliefs available for individual. Here are the income tax rates for personal income tax in Malaysia for YA 2019. The median monthly income for Malaysian households continued to grow in 2019 albeit at a lower pace of 39 per cent as compared to a growth rate of 66 per.

Malaysian developments Updated Guidelines on Earnings Stripping Rules ESR As highlighted in earlier alerts the Income Tax Restriction on Deductibility of Interest Rules 2019. For example lets say your annual taxable income is RM48000. Get in touch with us now Apr 14 2022 In 2019 the tax revenue received in Malaysia amounted to approximately 454 billion US.

With the Budget 2019 the RPGT for disposal of real estate from the 6th year of ownership onwards will be increased. Increase to 10 from 5 for companies. There are exemptions from Sales Tax for certain persons eg.

On the First 20000 Next. Malaysia Income Tax Rates and Personal Allowances Review the latest income tax rates thresholds and personal allowances in Malaysia which are used to calculate salary after tax. 26 when the income is between 600001 and 1 million.

A non-resident individual is taxed at a flat rate of. The content in this tax guide is provided by EY. One of the key proposals in this years Budget is the increase in individual income tax rate highest band from 28 percent to 30 percent for resident individuals with chargeable.

20192020 Malaysian Tax Booklet.

Real Property Gains Tax Rpgt In Malaysia 2022

St Partners Plt Chartered Accountants Malaysia Malaysia Income Tax An A Z Glossary Want To File Your Income Tax In Malaysia 2019 But Don T Know What Half The Terms Mean From

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

How To Calculate Foreigner S Income Tax In China China Admissions

Income Tax Formula Excel University

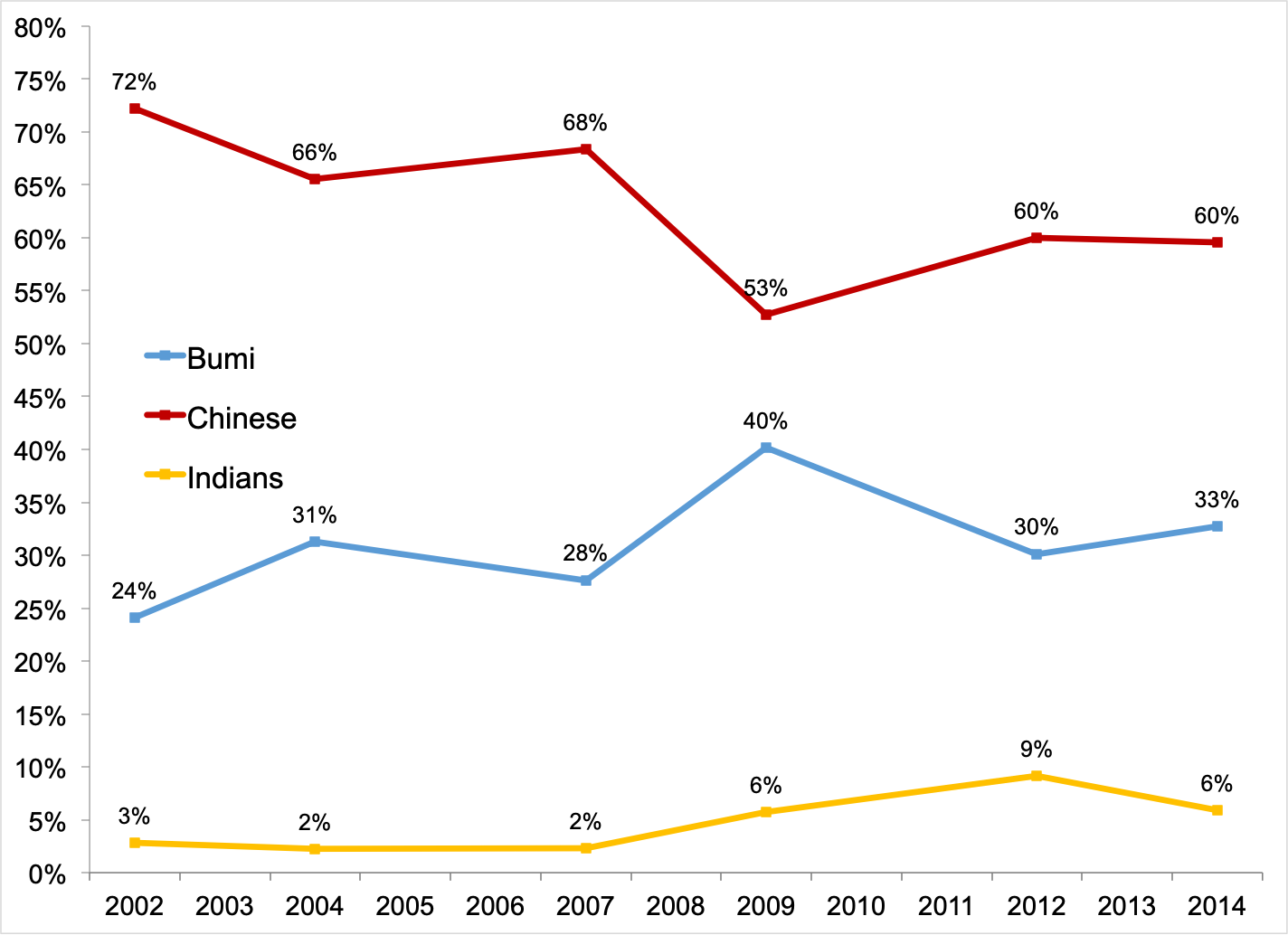

Income Inequality Among Different Ethnic Groups The Case Of Malaysia Lse Business Review

Ecuador Tax Preparation Time Data Chart Theglobaleconomy Com

New Zealand Tax Income Taxes In New Zealand Tax Foundation

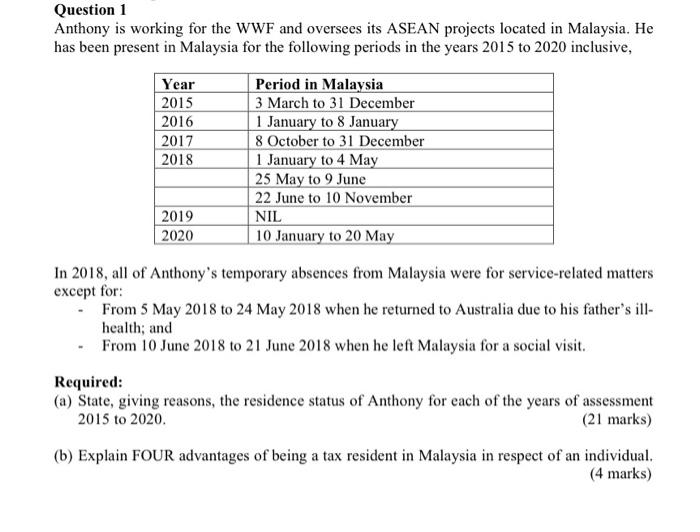

Solved The Following Tax Rates Allowances And Values Are To Chegg Com

Corporate Tax Rates Around The World Tax Foundation

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Corporate Tax Rates Around The World Tax Foundation

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Income Inequality Among Different Ethnic Groups The Case Of Malaysia Lse Business Review

Malaysia Personal Income Tax Guide 2020 Ya 2019

Us New York Implements New Tax Rates Kpmg Global

Free Online Malaysia Corporate Income Tax Calculator For Ya 2020

Comments

Post a Comment